The ongoing crisis surrounding China’s second largest property developer, Evergrande, has captured the attention of the financial press and investors across the world, as Schroders’ investors discussed last week.

Many commentators have long warned about the risks building up in China’s property market due to the huge, debt-fuelled expansion over the past two decades. The fear is Evergrande could be the first domino to fall in a potentially deeper or more systemic crisis. After missing an $84 million dollar bond payment last Thursday, the company now has a 30-day grace period to make payment. Failure to do so would see the company officially default on its debt.

Amid all the negative headlines, could there be opportunities? It’s important to keep a level head in these situations, especially as much uncertainty persists. However, we think that in an Asian fixed income context, valuations warrant closer examination. While it may not be the time to load up on real estate exposure, we would see this as a chance to buy the debt of good companies at attractive levels.

Why market commentary is too negative

We believe that market fears are ultimately overdone. Debt is high in the property sector, but coming down, spurred by regulatory measures. Evergrande, while large, accounts for less than 5% of a fragmented market, with the top 10 firms having a combined market share of just 26% last year, according to Statista. Meanwhile the banking sector exposure to Evergrande is sub 0.3%.

The crisis should therefore be manageable, and remain contained to the real estate sector. While policymakers will continue to focus on curbing debt levels, they are likely to step in to provide support if needed. Among other things, government-backed developers will probably take on some of Evergrande’s unfinished construction projects.

The fierce market reaction, which has largely been confined to the property sector, has ultimately left bond valuations in the sector looking excessively low. Given the ongoing uncertainty of Evergrande, the policy backdrop, debt reduction and economic slowdown in China, there is a clear need to be selective.

What is the significance of Evergrande?

Property has been a central pillar of the government’s vast programme to urbanise, develop and increase prosperity in the economy over the past two decades. Many companies financed their expansion with increased debt.

In Evergrande’s case, its high debt level has caught up with it. The company had shown signs of strain over several months, selling assets to stay solvent. It was unable to make a bond coupon payment due in September and a debt restructuring now looks a likely outcome.

We can get an idea of the potential systemic risk if we look at the rise in the sector weighting of property in the Asian corporate bond market. For the Asian credit market as a whole, real estate is about 13-14% today, up from 1.8% in 2005. For high yield, real estate has increased from 0.9% in 2005, to about 40% today. High yield is riskier than investment grade since high yield companies have higher levels of debt.

Why will systemic risk be avoided?

The fact that banking sector exposure and Evergrande’s overall market share are low means any resulting increase in bad debts or defaults should be manageable. However, there are likely to be other spillover effects to broader activity in the property sector, as well as to demand and prices.

There are signs of contractors becoming reluctant to work on existing projects, banks and suppliers reining in exposure, and uncertainty appears to be deterring prospective house buyers.

Based on past experience, with pre-sales on the decline, we can expect the authorities to start to intervene quite soon; there has typically been support announced after 4-6 months of falling pre-sales. The government would certainly seek to avoid a protracted or pronounced house price slump, given the detrimental effect this would have to household wealth, therefore consumption and the overall economy.

The question of policy intervention is less clear cut than in the past, however, as the government looks to curb debt levels and speculation in the sector. Last year, it introduced the “Three Red Lines” policy, essentially limiting levels of debt a property company is permitted to hold.

Future policy moves will likely amount more to fine-tuning, balancing the need to support the market with the need to reduce debt.

It is welcome to see most property developers have begun reducing debt and are on course to comply with the three red lines. Ultimately though, it will be a bumpy process, potentially exposing disparities between stronger and weaker companies. Defaults will increase, but we ought to see the emergence of clear market leaders too.

Has the sell-off created opportunities?

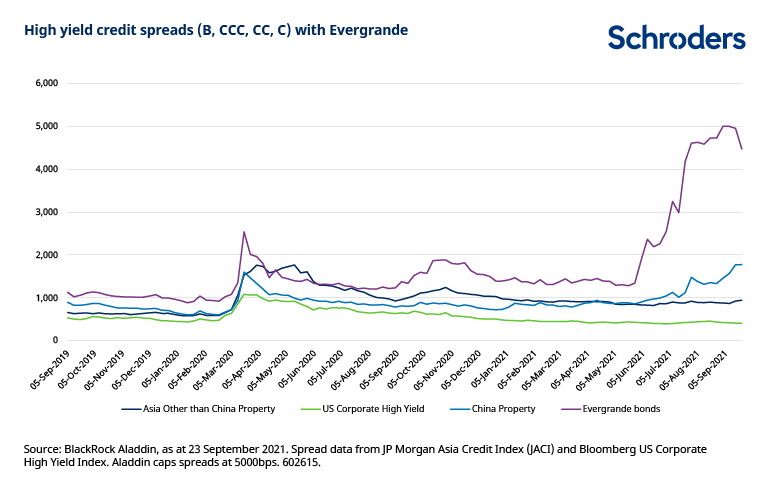

The sell-off has been fierce, but it has been confined to the property sector, as the charts demonstrate. Spread indicates the level of extra yield above comparable lower risk bonds and move inversely of prices.

This market level implies a default rate in the Chinese property sector of about 20% for the next 12 months. That looks too high. The sell-off of Asia property relative to the rest of the market, and to the US, also looks excessive.

In BB, the highest quality high yield rating, the spread on Asia property bonds has risen from about 690 basis points (bps) at the start of September to about 980bps. There has been no spillover to other parts of the Asian high yield markets so far.

Expectations for continued market volatility and a challenging business environment will give rise to significant divergence in performance between credits. Selectivity, therefore, remains crucial.

With valuations having priced in a notable amount of downside risk, the higher quality segment of the China high yield market, both in the property sector and more broadly, offers attractive opportunities.