- US dollar denominated EM bonds that have recently come under pressure could see a recovery in 2020, especially if pragmatic policies and credible debt restructurings are implemented.

- There is space for a number of EM central banks to continue monetary easing, supporting long-dated local government bonds in countries where real yields are still at historically high levels.

- We are also looking for signs of a convincing cyclical upturn in EM growth to turn unequivocally bullish on EM currencies.

Global growth expectations are depressed, so the bar appears to have been reset at low levels for positive growth surprises next year, especially in emerging market (EM) countries. With tentative signs of growth stabilisation and oversupplied global liquidity, a number of bond markets could see yields rise.

However, the risk-reward balance remains attractive in several high yielding EM local debt markets. This is due to high levels of real rates, controlled inflation and contained balance of payments vulnerabilities. EM currencies are also well positioned to recover strongly in 2020.

Where are the risks and opportunities in 2020?

EM hard currency debt

EM hard currency debt performed well in 2019, mostly as a result of the decline in US Treasury bond yields and the surge of inflows into this sector. In 2020, we expect EM dollar denominated debt to remain within the range seen over the past 10 years, as shown in chart 1.

Chart 1: External debt (EMBIG Diversified) spread Source: Schroders; Bloomberg – 31 October 2019

Source: Schroders; Bloomberg – 31 October 2019

The persistence of this long-term range in EM sovereign spreads implies that most of the price gains in EM external debt will be largely dependent on what happens to US Treasury bond yields. Despite the oversupply of liquidity from global central banks, we believe that EM sovereigns with good risk metrics are unlikely to provide attractive returns in 2020.

Yields in good quality sovereigns are very low and investor positioning appears overextended. We remain patient, continuing to monitor sovereign bonds which are experiencing a substantial re-pricing and which could see a recovery in 2020; if the right policies are implemented and/or some form of debt restructuring has been achieved.

Indeed, the stability in EM sovereign spreads highlighted in chart 1 masks a series of sovereign crises experienced by a number of EM countries during the 2018-19 period. Argentina, Ecuador, Lebanon, Turkey, Venezuela and Zambia are amongst the countries which have experienced significant macroeconomic challenges, with their bonds re-pricing sharply as a result. The good news is that these crises have been relatively contained. We expect contagion to remain limited, especially given improving global financial liquidity conditions.

EM local debt and currencies

The decline in developed market bond yields in 2019 has also benefited EM local rates, which have collapsed to historically low and unappealing levels. However, there continue to be attractive pockets of value, for example, in the local government bonds of Mexico, Russia, South Africa, India and Indonesia. In Brazil, real yields have reached low levels, and while it may be prudent to take some profit, we believe a core exposure should be maintained.

All of these markets are expected to provide attractive returns in 2020. This is thanks to high real yields, controlled inflation, and because the easing cycle is expected to remain firmly in place given continued policy focus on reviving domestic economic activity.

We also see scope for EM local debt to benefit from a potential recovery in EM currencies in 2020. Recent US dollar strength, the escalation in the US-China trade war, and declining global growth and trade have been broadly negative for EM currencies. In most cases, currencies have weakened to their all time lows seen during the balance of payments crises of 2013-15.

We are now seeing tentative evidence of a burgeoning cyclical upturn, alongside more favourable global liquidity conditions. A confirmation of this turnaround would likely create the conditions for a strong recovery in EM currencies.

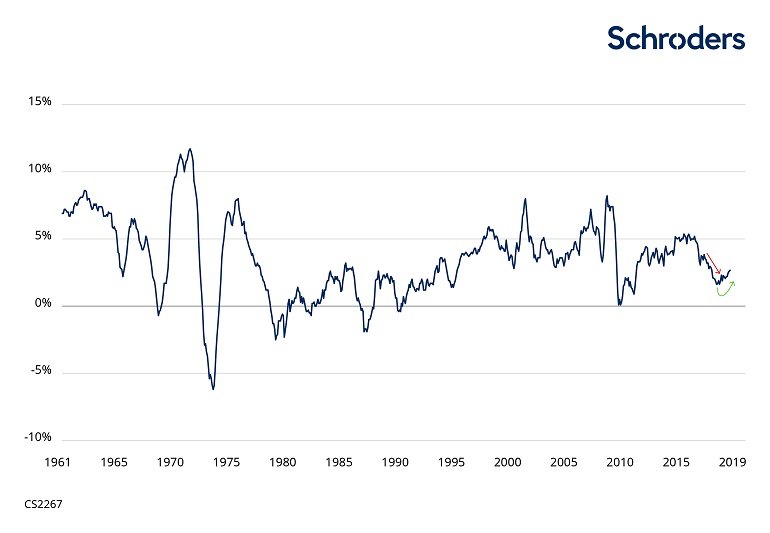

As can be seen in Chart 2, the severe liquidity tightening of 2018, which exacerbated the global slowdown and triggered a number of EM crises, appears to have run its course. This recovery in global financial liquidity is still in its early stages and appears to have been driven mainly by central banks. By contrast, private liquidity creation (i.e. commercial bank lending) remains globally subdued. Global bank lending needs to reaccelerate for the recent liquidity trends to become unequivocally bullish for the global growth outlook.

Chart 2: Global financial liquidity measure (based on global real M2 growth) Source: Schroders; Bloomberg; Thomson DataStream – 31 October 2019

Source: Schroders; Bloomberg; Thomson DataStream – 31 October 2019

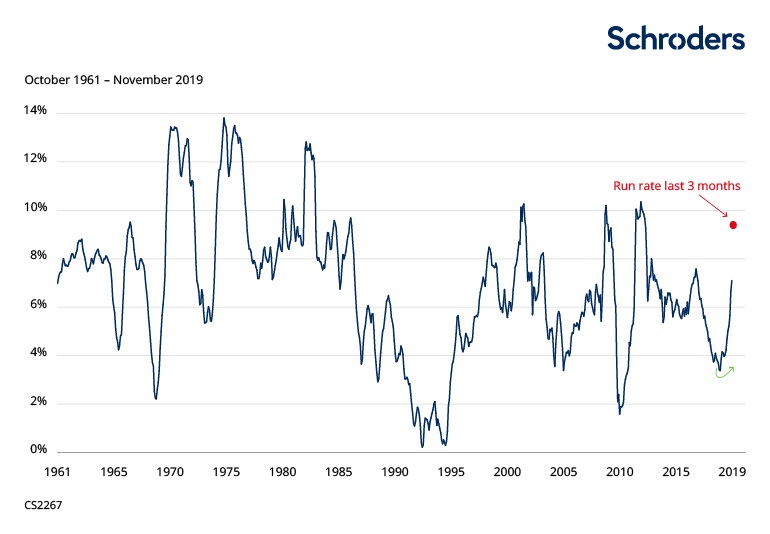

Chart 3 highlights that the US has been the biggest contributor to the recovery in global monetary aggregates. US money supply (M2) has surged over the course of the last three months to historically high levels. As can be seen, the current run rate of US M2 growth is matching the liquidity surge of 2009 (in the aftermath of the global financial crisis) and in 2012 (in response to the eurozone crisis).

As a reminder, the surge in buying of US Treasuries by commercial banks has recently been a major source of tightening in US dollar liquidity (crowding out). But the Federal Reserve has been forced to intervene with large repo operations and renewed balance sheet growth.

Chart 3: US money growth (year-on-year) Source: Schroders; Bloomberg; Thomson DataStream – 31 October 2019

Source: Schroders; Bloomberg; Thomson DataStream – 31 October 2019

Given the surge in money growth in the US, we may now be seeing an oversupply of dollar liquidity, which could be the catalyst required for the US dollar to weaken. If this happens, the US will start to export this liquidity to the rest of the world at a time when we are already seeing some tentative evidence of a cyclical upturn in key countries such as China.

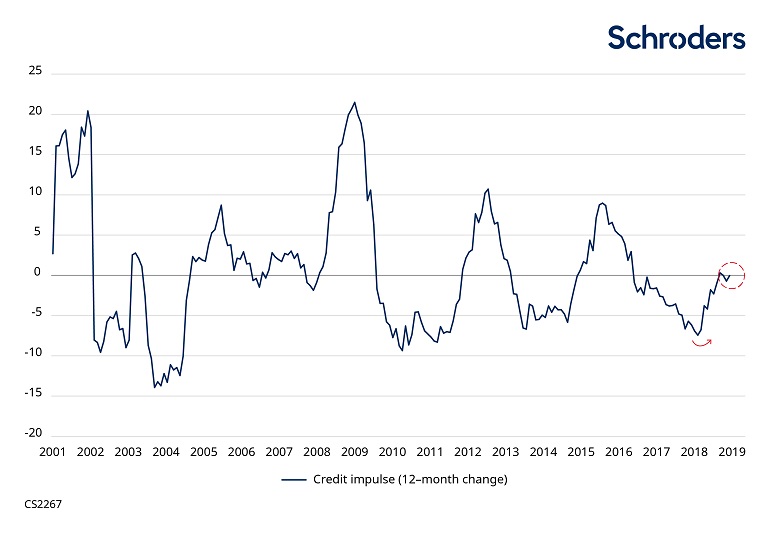

In China, the credit impulse has improved in recent months. While this improvement is not as convincing as in 2009, 2012 and 2016, monetary and credit conditions in China will be less of a drag in the next few months. Indeed, we came back from our recent research trip to China with the view that the worst may be over in terms of domestic economic activity.

Chart 4: China credit impulse

Source: IMF; Bloomberg; Schroders – 31 October 2019

Source: IMF; Bloomberg; Schroders – 31 October 2019

You can read and watch more from our 2020 outlooks series here

To find out more about the Emerging Markets strategic capability, please click here